Key Takeaways

- A well-designed settlement plan is vital for turning settlement proceeds into lasting financial security.

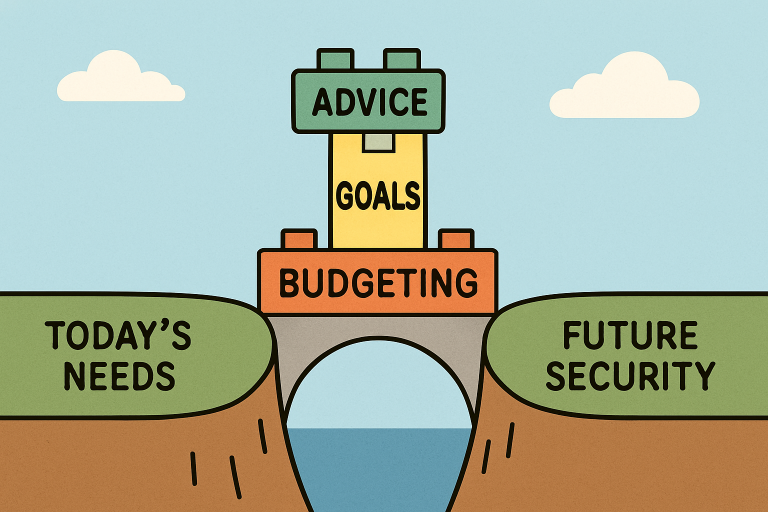

- Successful plans strike a balance between immediate needs, long-term goals, and risk management.

- Professional advice ensures a settlement plan is legally sound, tax-efficient, and adaptable to changing circumstances.

Table of Contents

- Understanding Settlement Planning

- Key Components of a Successful Settlement Plan

- The Role of Structured Settlements

- Common Challenges in Settlement Planning

- The Importance of Professional Guidance

- Steps to Develop an Effective Settlement Plan

- Real-Life Examples of Successful Settlement Plans

- Conclusion

Understanding Settlement Planning

Reaching a legal settlement can be a pivotal financial event, but without a solid plan, those funds can evaporate quickly. Settlement planning involves a strategic approach to managing your settlement money in order to support your immediate needs and long-term well-being. Whether funds stem from a personal injury claim, workers’ compensation, or another legal settlement, the right plan prevents premature depletion and supports stable financial health. For many, a customized settlement plan brings peace of mind, disciplined spending, and a future-focused investment approach.

While the emotional relief of receiving a settlement is immense, so too can be the accompanying pressures. Settlement funds often must fulfill multiple roles — from paying for ongoing care and supporting dependents, to investing for retirement. A disciplined plan maximizes every dollar and helps recipients stay in control, rather than reacting to short-term temptations or unexpected emergencies.

Personal goals, family needs, and future contingencies should all be reflected in the structure of your plan. Failing to plan can lead to impulsive decisions or overestimating the duration of funds. Without a thoughtful budgeting strategy, even large sums can drain faster than anticipated.

Consulting qualified advisors is key, but ultimately, the plan should fit your life and aspirations – not just your balance sheet. Understanding the fundamental components of settlement planning sets the stage for successful financial management for years to come.

Key Components of a Successful Settlement Plan

Effective settlement plans share several essential features:

- Clear Financial Goals: Every decision should support specific and realistic goals. This might include debt payoff, homeownership, education, retirement, or healthcare costs. According to Investopedia, using the SMART method —specific, Measurable, Achievable, Relevant, and time-bound —can help clarify priorities and track progress effectively.

- Comprehensive Budgeting: Begin with a practical assessment of current living expenses and obligations. Allocate funds for needs, wants, future investments, and savings targets to cover unplanned events, such as medical emergencies or inflation.

- Investment Strategy: Not all settlement money should sit idle. Explore age-appropriate investment options, such as mutual funds or bonds, to maximize returns while considering your personal risk tolerance. Sound investment secures future purchasing power.

- Risk Management: Identify potential threats to your settlement’s value, such as significant market shifts, unexpected illnesses, or legal liabilities. Using tools such as insurance and diversified portfolios can help fortify your plan against adverse events.

When building a plan, pay special attention to how timing and tax rules will affect lump sum and structured payments. The right approach strikes a balance between liquidity and protection, ensuring you can meet both day-to-day obligations and long-term goals.

The Role of Structured Settlements

Structured settlements are a powerful tool that transforms a large, one-time payment into a predictable stream of income. They offer distinct advantages, including:

- Financial stability: Payments arrive on a regular schedule for a set term, supporting daily expenses and reducing the temptation to overspend.

- Tax benefits: In many cases, periodic payments are tax-exempt, which further safeguards long-term value.

- Customization: Payouts can be structured to coincide with life milestones, such as education costs, medical procedures, or retirement dates.

Structured settlements are increasingly popular for those seeking consistency and adopting a cautious approach to windfalls.

Common Challenges in Settlement Planning

Even the best-laid plans may encounter obstacles. Frequently faced difficulties include:

- Inaccurate Expense Projections:Underestimating future needs, such as rising healthcare costs, can rapidly exhaust settlement funds.

- Inflexibility: Life changes quickly. Plans must be adaptable to marital transitions, the addition of new dependents, or changes in health conditions.

- Neglecting Regular Reviews: Without scheduled evaluations, it’s easy for a plan to fall out of step with an individual’s actual needs and lifestyle.

Recognition and proactive management of these challenges are crucial to ensuring a settlement continues to serve you over time.

The Importance of Professional Guidance

Professional input is invaluable during the settlement planning process. Financial advisors, accountants, and legal professionals offer personalized guidance on tax optimization, investment growth, risk management, and legal compliance. They help identify blind spots and opportunities that might otherwise be overlooked. Numerous studies, including those reviewed by major financial publications, confirm that individuals who consult professionals tend to achieve stronger, more sustainable financial outcomes and greater peace of mind.

Steps to Develop an Effective Settlement Plan

- Assess Personal and Financial Needs: Inventory existing resources, debts, obligations, and immediate family needs, including future goals such as education or homeownership.

- Determine Suitable Settlement Structures: Analyze different payout scenarios — whether lump sum, structured payments, or a hybrid — and measure them against your objectives.

- Engage Professional Advisors: Involve experts to craft a legally compliant, tax-efficient, and goal-aligned plan.

- Regularly Review and Adjust the Plan: Life circumstances evolve. Set annual or biannual reviews with your advisors to refine the plan as your needs and the economic landscape shift.

Conclusion

Successful settlement planning goes far beyond managing a financial windfall; it’s about building a bridge between today’s priorities and tomorrow’s opportunities. By understanding the essential components, crafting a plan tailored to your needs, and leveraging professional insight, you can transform a settlement into lasting peace of mind and prosperity. With diligence, discipline, and adaptation, your settlement can support both immediate dreams and lifelong security.