Table of Contents

- Introduction

- Current Landscape of Fixed-Rate Loans

- Economic Indicators to Monitor

- Impact on Borrowers

- Strategies for Managing Fixed-Rate Loans

- Conclusion

Introduction

As 2026 approaches, the dynamics governing fixed-rate loan rates are drawing increasing attention from both borrowers and investors. Understanding the trends, predictions, and underlying economic drivers is more important than ever for making sound financial decisions. For individuals seeking predictable loan payments and stability, fixed-rate products remain a primary consideration. Many borrowers now prefer the convenience of applying online for a Maxlend loan, which streamlines the approval process and allows faster access to funds. Whether you’re managing personal expenses or planning for significant commitments, evaluating the outlook for these rates will be crucial. Resources such as MaxLend loanscan help you compare options and stay up to date on the latest rate developments.

Against the backdrop of recent economic shifts, the lending landscape remains both promising and challenging.

Current Landscape of Fixed-Rate Loans

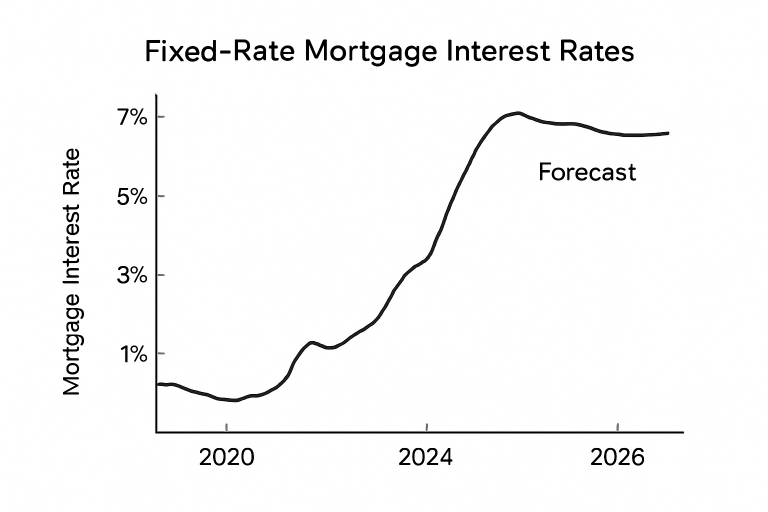

Over the past several years, fixed-rate loan products, particularly mortgages, have seen notable fluctuations. In late 2024, the average rate for a 30-year fixed mortgage in the U.S. climbed to 6.91%, representing the highest mark since mid-2024. This uptick was primarily driven by the surge in bond yields, a critical benchmark for lenders when setting mortgage rates. Such fluctuations underscore the importance of tracking broader financial markets and their influence on lending products. The recent cycles of rate increases have reshaped affordability for homebuyers and other long-term borrowers. What was once an era of deeply discounted borrowing in the early 2020s has become a market characterized by careful qualification and heightened monthly obligations.

Economic Indicators to Monitor

Fixed-rate loans do not operate in a vacuum; several key economic indicators provide insight into future movement:

- Inflation Rates: If underlying inflation persists, lenders boost rates to maintain margins, leading to higher costs fr borrowers.

- Employment Data: Indicators of a softer jobs market may encourage the Fed to reduce rates to stimulate demand.

- Housing Market Trends: Increased housing supply and moderated home prices can help ease upward pressure on borrowing costs by shifting the supply-demand balance.

Impact on Borrowers

Prospective borrowers should expect a “new normal” of elevated rates through 2026. This impacts not only home loans, but also auto loans, student loans, and personal lending. The most prudent strategy is to:

- Budget for Higher Payments: Prepare for monthly payments reflecting today’s heightened rate environment.

- Explore Loan Products: Evaluate various types, including adjustable-rate mortgages (ARMs), for potential savings during periods of falling rates.

- Strengthen Credit Profiles: Work to boost credit scores through timely payments and reduced debts, securing better loan terms.

Strategies for Managing Fixed-Rate Loans

1. Locking in Rates Early

If trends suggest a further increase in rates, consider locking in as soon as possible to avoid higher borrowing costs.

2. Refinancing Opportunities

Should rates decline, refinancing an existing loan could lower monthly costs or reduce total interest paid. Keep a close watch on rate movements to time any refinance application effectively.

3. Seeking Professional Advice

A certified financial advisor or mortgage professional can help tailor decisions to your specific situation, ensuring you don’t miss opportunities or pay unnecessary costs.

Conclusion

The year 2026 is set to bring continued evolution in fixed-rate loan rates, shaped by macroeconomic developments. With rates projected to ease but remain above recent lows, strategic management and informed decision-making will be essential for borrowers. Monitoring trusted news sources and consulting with financial professionals can provide timely insights, helping you adapt to whatever comes next in the lending landscape.